History suggests Australia's Free Trade Agreement (FTA) with China will not bring in the money claimed, a QUT economist has warned.

The Federal Government yesterday (MONDAY) signed the FTA with China after nearly 10 years of negotiations, covering 14 commercial agreements potentially worth more than $20 billion.

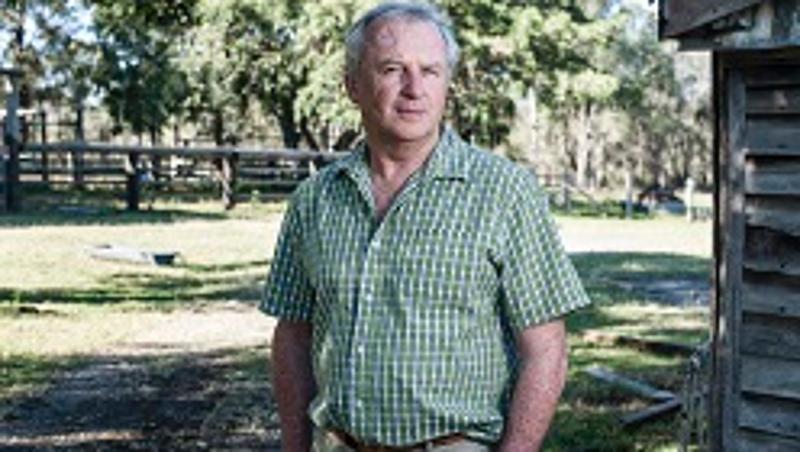

But Dr Mark McGovern, from QUT's Business School, cautioned that Australia had historically fared poorly in FTAs.

"With these sorts of agreements the reality can be very different to the promise," Dr McGovern said.

"If you look at the history of previous trade agreements, including Australia's with the US and with Thailand, the reality is that Australian trade balances have deteriorated.

"The really important question is, what is different this time that is going to make us winners?"

Dr McGovern said it was "reprehensible" the details of the FTA had not been released publically before the deal was signed. He criticised the Federal Government for not taking the needs of exposed Australian industries more seriously during the negotiations.

"Given our sad 40-year history of net external trade losses and greater indebtedness under this sort of thinking, it really isn't good enough when you are getting details about agreements constructed by select advisers and some politicians after everything is signed," he said.

"The government really should have been talking to industry figures while negotiating this deal because they are on the front line and they are the ones who will be most affected - both positively and negatively."

The deal raised the prospect of more foreign investment in Australian agriculture, which could be a "blessing or a curse".

"Everyone would love to see real gains for both Australia and China, but this requires much stronger mutual understanding of real impacts and realisable possibilities," Dr McGovern said.

"You can almost see the glint in the eye of some of our political leaders as they think about the money that could be flowing into Australia, but foreign investment is a mixed bag.

"Foreign investment can erode sovereignty and this agreement has not addressed the issue of foreign investment intentions and how these will be monitored. The deal also includes an Investor State Dispute arrangement which is a mistake and explicit recognition of limited mutual trust at the corporate level."

Dr McGovern said some in the agricultural industry would be concerned the FTA would make it easier for overseas investors to control and consolidate supply chains.

"For example, you could have Chinese, Korean or other farmers buying land in Australia and supplying milk to north Asia through their own processors. Yes, they will be able to also buy milk from Australian farmers, but farm gate returns are miserable as it is, without allowing further supply chain integration and extended corporate dominance.

"The government seems to think the job's done when we get the deal signed. But it needs to also establish proper institutions to ensure Australia is getting decent returns from our national resources and sustainable gains on all sides."

Dr McGovern said the FTA had potential to bring welcome investment to some struggling Australian industries, but China, like others before, would work hard to ensure it had the best end of the deal.

"Other nations have proved very good at understanding how to gain from this sort of preferential agreement, but we haven't," he said.

"The government is selling this deal very hard but the people in the industries that will be affected should be asking serious questions. We've got to be careful to distinguish the politics of this agreement from the economics.

"As one farmer told me recently, when he was travelling in China one of his hosts noted, `in Australia you're very good marketers, but you're not good traders.'"

Media contact:

Rob Kidd, QUT Media, 07 3138 1841, rj.kidd@qut.edu.au

After hours, Rose Trapnell, 0407 585 901