Society needs to learn from the global financial crisis, and the biggest lesson for financial corporations is of the need for integrity, according to QUT researcher and author Professor Justin O'Brien.

Professor O'Brien, who has followed the financial market closely for years and written a number of books on the subject, said the collapse of major financial institutions, markets in freefall and worldwide panic had made this financial crisis the biggest we have seen.

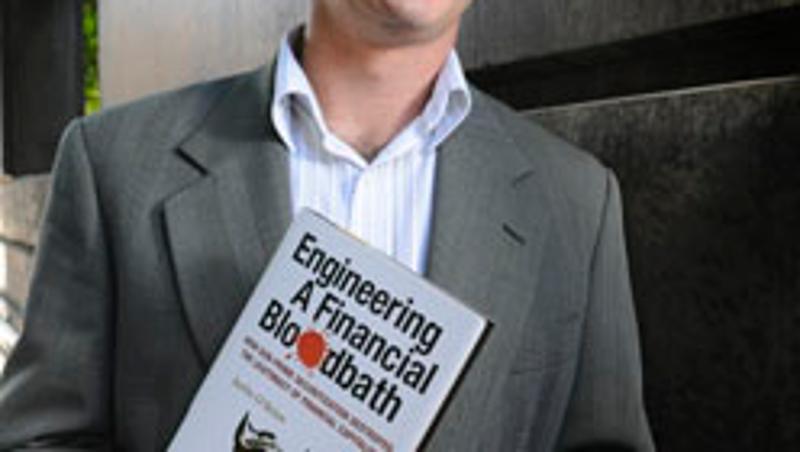

He will be hosting a public lecture at QUT on Monday August 3, where he will also be launching his latest book, Engineering a Financial Bloodbath.

"There are always financial crises; every few years, there is a boom-bust cycle which is quite regular," he said.

"Due largely to the fact this has filtered down to the public, who are now essentially cleaning up the mess made by the finance industry, there will now have to be huge changes in the operation of these organisations."

Professor O'Brien said new rules and tighter regulations would not work because they were easy to work around, and neither would an approach based on principle alone.

Instead, he recommednded a normative approach linking rules and principles with a focus on socially accepted norms to better control financial corporations and ensure consumer confidence once again rose.

"We have got to re-think the theory and practice of financial regulation because there is no question that financial capitalism is a force for good if applied in a reasonable fashion, but given the extent of socialised costs in the past few years, it needs a new strategy to ensure sustained recovery," he said.

"Recovery has to be informed by better or smarter regulation, which has the capacity to be applied in a dynamic responsive manner.

"There also has to be a sustained effort to embed broader conceptions of integrity, within corporations and markets, so confidence can increase: business confidence does not return because somebody has said it has, there has to be a good reason for that confidence to come back.

"There is, at the moment, an accountability and integrity deficit, and by embedding integrity through design, the inevitable gaps in any regulatory framework can be adequately resolved."

While Australia had done "exceptionally well" throughout the current crisis compared to other countries, Professor O'Brien acknowledged there was still some heartache ahead.

"There is still a high level of psychological distress out there, and that will continue for some time to come, even though the freefall of the markets we have seen has ceased."

In a first at QUT, Professor O'Brien's lecture will be broadcast in Second Life. QUT Law is a leader in the use of Second Life but this will be the first time they broadcast a public lecture in the virtual world.

Media contact: Sharon Thompson, QUT media officer - 3138 4494 or sharon.thompson@qut.edu.au

**Hi-res pics available for media